--

With the agreement for Bulgaria and Romania to become members of the European Union, our country has committed to become part of the Eurozone when it meets the necessary criteria for membership. Upon entry, the euro will become the country's main currency and will replace the lev as such. It is envisaged that Bulgaria will be accepted into the euro area from 01.01.2026.

The IBAN of your current account in BGN will remain the same and the Bank will automatically convert the balances of accounts and deposits in BGN at the BNB fixing rate.

No changes are required to existing authorisations and they remain valid.

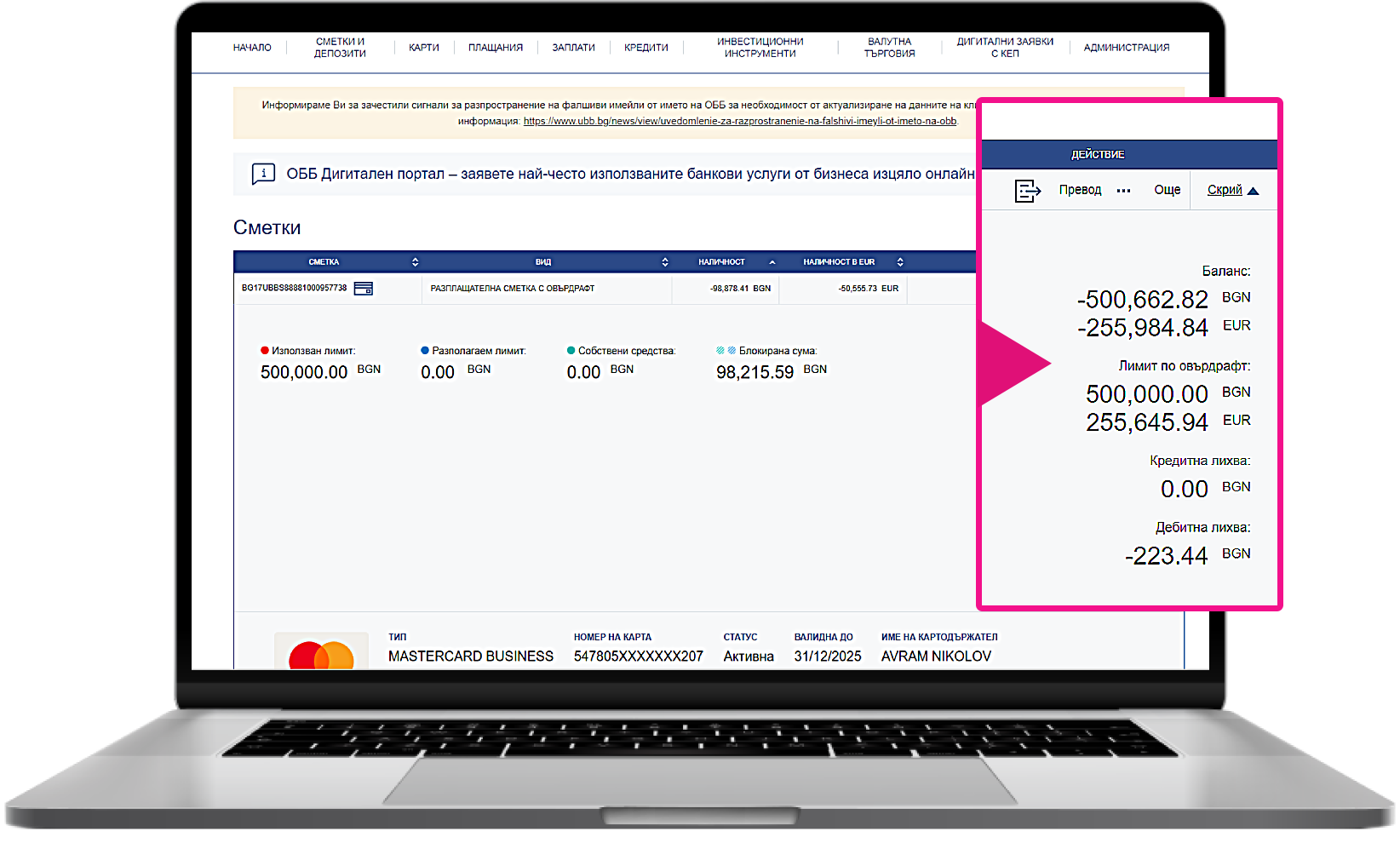

Till 08.08.2026, in Certificates/References/Audit Confirmations for accounts that were in BGN. Bank will apply dual visualization for balances, transactions and charges.

For the accounting date 30.12.2025 the Bank will generate statements for all customers with accounts in BGN. In the first statement for 2026, the opening balance of these accounts will be zero. The first incoming transfer will be for the amount of the converted opening balance from BGN to EUR, at the BNB fixing.

The format and visualisation of the information is retained. The Bank will continue to display a dual visualization in euro and lev until 08.08.2026.

МТ940 statements

The structure of the statement is maintained. Four new transaction codes are introduced which will be used once for the purpose of automatic revaluation of account balances that were in BGN:

Following the introduction of the euro, transfers in national currency will be as follows:

| Before December 31, 2025 | After January 1, 2026 |

|---|---|

| Standard transfer in BGN via BISERA | Standard transfer in EUR to an EEA country (SEPA) |

| Instant transfer in BGN | Instant transfer in EUR to an EEA country (SEPA Instant) |

| RINGS transfer | Express transfer in euro to an EEA country (TARGET2) |

| Recurrent transfer in BGN in the country | Recurrent transfer in EUR in the country |

Direct Debit - The direct debit service has been discontinued.

In case you need information about account movements in BGN, you need to split your search into two periods - until December 31, 2025 and after January 1, 2026.

All transfers and requests in BGN need to be sent to the Bank for processing by the last business day of 2025 at the latest.

The created templates are saved, and the Bank will automatically convert the currency from BGN to EUR.

The structure of the current file formats, including payroll and budget payment files, are retained.

On 01.01.2026, all your loan amounts will be automatically converted into EUR at the official exchange rate.

If you have fixed rate interest they will remain the same.

If you have a variable rate, the total interest rate at conversion will be identical as the one just before the conversion and will be composed as in the actual interest rate formula of a base rate and a margin. The base rate component of the interest rate will be converted to a EUR base rate which is calculated with the same formula as currently used in your contact.

To accept payments in BGN until 31.12.2025 you do not need to make any changes to the settings up to and including this date.

To accept payments in EUR from 01.01.2026, you need to update the Currency parameter in the payment requests after 00:00 on 1 January 2026:

In the absence of an update, payments in EUR will not be processed.

The software of all POS devices will be automatically upgraded to work with euros. A prerequisite for this is that you switch the terminal on before the end of the year.

There is no legal requirement for dual display (EUR/BGN) of POS receipts and UBB does not foresee such.

In the period from 01.01.2026 to 31.01.2026, ATMs will only allow deposits in BGN and withdrawals will only be made in EUR.

As of 01.02.2026, all ATM deposit and withdrawal operations will be carried out in euro only.

Until 30.06.2026, the Bank will accept cash deposits in BGN and will exchange BGN for EUR at the cash desk, free of charge. These transactions will be converted from leva to euro at the BNB fixing rate.

The Bank has set up 35 offices in 23 cities, which have increased capacity to handle cash transactions.

The current contracts and terms will remain in place, and the relevant fees will be automatically converted from the BGN into Euros, at the BNB fixing rate.

If, after the introduction of the euro, items are collected in lev, the account will be endorsed in euro at the BNB fixing rate.

In order to provide the highest quality and most efficient service in all our branches after 1 January 2026, we ask you to make an appointment in advance. This will allow us to:

Cash withdrawal

Cash deposit

If you frequently deposit amounts over EUR 10 000, we recommend the "Deposit with Envelope" process which gives you: