Useful facts about investments

What is investment?

An investment is an asset or object acquired for the purpose of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time. When a person purchases an asset as an investment, the intention is not to consume it, but rather to use it in the future to create wealth. An investment always refers to the expenditure of some resource today - time, effort, money, or an asset - in the hope of a greater return in the future than what was originally invested.

Why invest?

Saving is always a smart move, but it's most useful as a fallback for unexpected situations. If the interest on your savings isn't enough, and inflation makes life more expensive, you can buy less and less with the same money over the years. Investing is therefore a good opportunity to improve or maintain your standard of living. Moreover, investing allows you to potentially use your money to make more money. If we compare it to cycling, saving is like a safe city bike and investing is like a nimble racing bike. One will get your money from A to B and not much more, while the other involves a bit more risk but can allow your money to really grow.

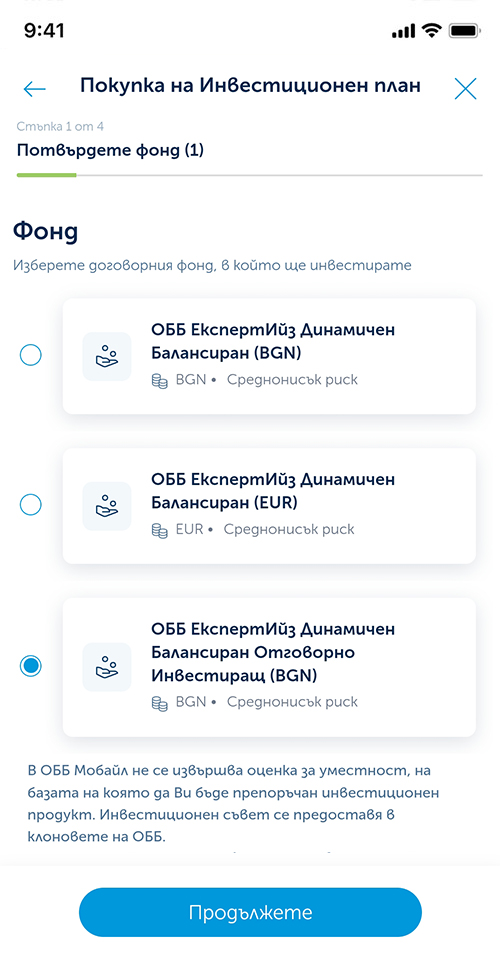

In what and how you invest with SIP?

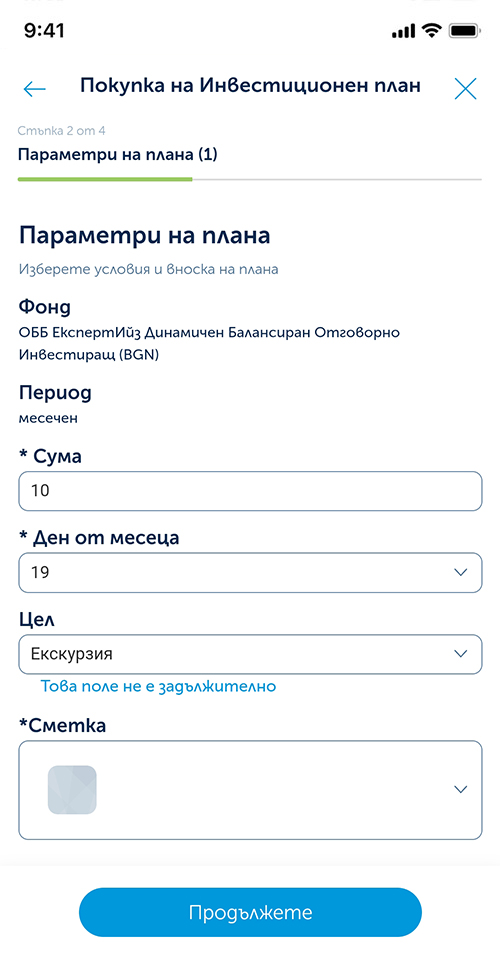

When you invest through a Systematic investment plan (SIP), each month the amount you have specified is automatically invested in a mutual fund of your choice distributed by UBB.

A mutual fund is a fund that raises capital from multiple investors. This capital is then invested in a portfolio of stocks, bonds, other funds or cash.

Mutual funds have different risk profiles and investment horizons that each client should become familiar with.

Mutual funds invest their clients' funds in various financial instruments. Some of the most common options include:

- Stocks

A security that gives ownership of a particular company. Owning a share of the company entitles you to a portion of the profits each year. This profit is most often received as a sum of money (bank transfer), which is called a dividend, or, if reinvested in the company's business, as an increase in its value (price). When a share goes up in price, the profit on the difference between the price at which the share was bought and the price at which it is sold is called capital gain.

Historically, stocks have offered good protection against inflation, especially stocks of companies with a competitive advantage and pricing power. Pricing power is the extent to which a company can raise its prices without reducing demand for its products.

- Bonds

A security that, broadly speaking, represents a debt (loan) that a country or company has taken on. In order to get the amount needed (for this loan), the country or company sells bonds. In exchange for these bonds, it receives the loan, and those who acquire the bonds receive interest from the state or company in the form of periodic payments. In these periodic payments, often only interest is paid, and the return of the original amount due (principal, which is also called the face value of the bond or par) remains at the very end, called maturity, along with the last interest payment. Interest payments and return of principal on bonds are most often mandatory, with no option to skip a payment. If this happens, the creditors (pension fund, mutual fund or other investor) can request the bankruptcy of the bond issuer - state or company.

- Investment (mutual) funds

These funds invest in a variety of financial instruments, including stocks and bonds. Such pooling of different types means that the fund's performance is not dependent on a single sector or company. Professional fund managers constantly monitor and make adjustments depending on the market situation.

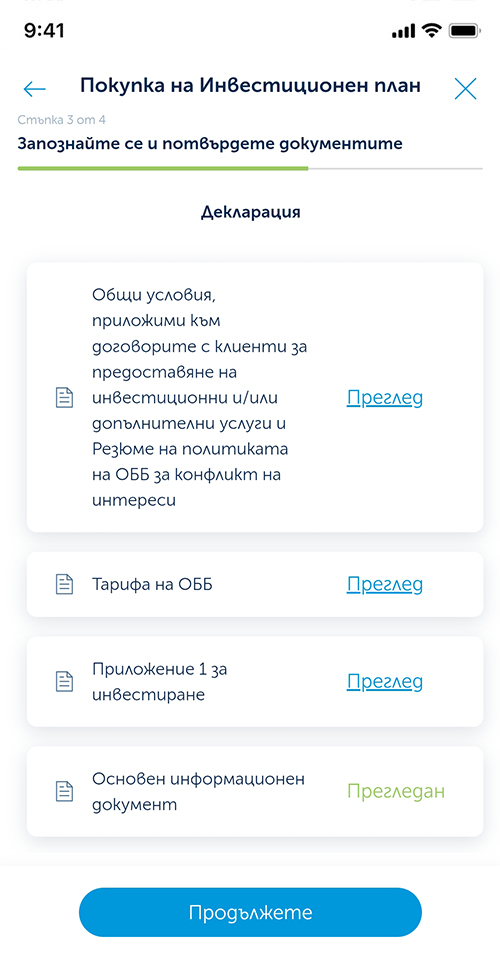

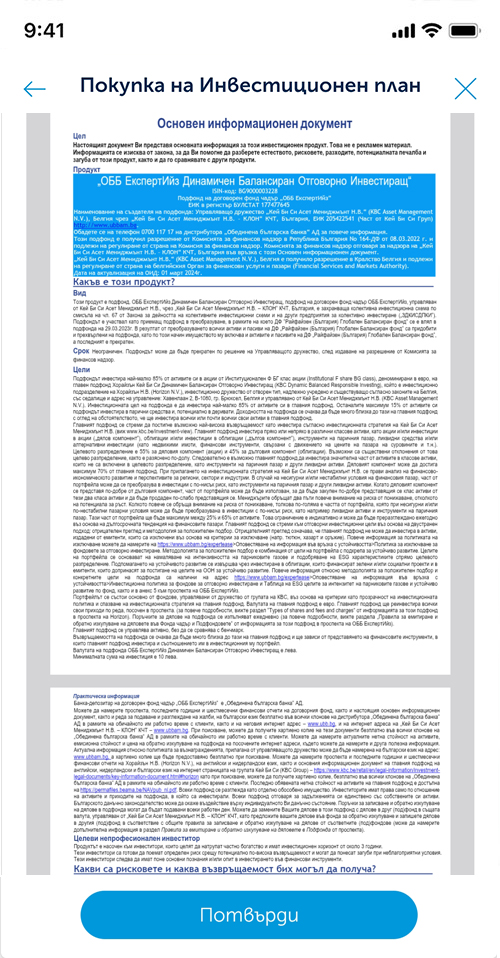

A mutual fund is managed by a certified portfolio manager who makes decisions on where to invest and what part of the portfolio to put into each financial instrument. When investing, the portfolio manager follows a predetermined investment policy (also called a strategy), which each investor in the fund must become familiar with before investing. This is mandatory to make sure that the policy of that mutual fund best meets the investor's expectations and objectives. Full details can be found in the mutual fund documentation.

Why do money love long-term investors?

The benefit of regular investing is that you build healthy financial habits that add value over the long term and get you closer to your goal. For the goals you've set and the strategy you've chosen to achieve them, it's important to be persistent to stick to the path you've set out.

Of course, investing can be emotional, but don't be tempted to stray from your plan. Remember, your plan can perform as expected if you stick to the recommended investing period.

The regular nature of investing allows you to benefit from an averaged cost per share, which could be to your advantage when financial markets fluctuate and with a long-term horizon. By investing at different times, you get an average price over time and you don't have to hesitate whether you have chosen the right time to invest your money.

7 of the most common mistakes when entering the world of investments

- Short-term information in the media

Investing with SIP allows us to isolate ourselves from information in the media. Regular investment allows short-term news to not affect the achievement of our long-term goals.

- Lack of clear investment objectives

Systematic investment plan allows for a focus on key long-term goals that should be tailored to each client's financial and life plan.

- Lack of sufficient diversification

Systematic investment plan allows for regular investments in a fund composed of multiple financial instruments - stocks, bonds, other funds, etc. This creates diversification that helps to avoid the risk of concentration in one or a few instruments. Finding a balance between long-term investment objectives and the risk profile of the fund is key to good performance.

- High volatility in financial markets

Long-term investing involves a well-diversified portfolio designed to provide the appropriate levels of risk and return under different market scenarios. However, even after creating the appropriate portfolio, it is difficult to predict or control which direction the market will take and what returns the investment will realize. Investing regularly and over the long term allows short-term market fluctuations to be minimised.

- Lack of a clearly defined investment horizon

The investment horizon is the length of time an investor holds their investment before selling it. Its duration is influenced by several different factors, but the main one is risk tolerance. Each mutual fund's main information document specifies a recommended holding period. The holding period is set to reduce the risk of market fluctuations and to allow sufficient time for the underlying assets to recover in the event of adverse market conditions.

It is theoretically believed that if the holding period is relatively short, it is not advisable to take a controlled risk in the form of an investment in a mutual fund because unpredictable movements are possible in the short term. The investment could develop if it has a long-term horizon of at least one business cycle.

Investment horizons are largely determined by the objective and strategy. For example, investing for a down payment on a house for perhaps two years would be considered a short-term time horizon, while investing for education would be a medium-term time horizon, and for retirement-a long-term time horizon. Each investor should carefully consider their own goals and the timing of the investment before deciding where to put their money. It is up to each investor to determine the optimal balance between risk and return.

- Taking too much, too little or the wrong risk

Investing involves taking some level of risk in exchange for potential gain. Taking too much risk can lead to large variations in investment returns that may be outside your comfort zone. Taking a small amount of risk can result in low returns to meet financial goals. Each investor should ensure that he or she knows his or her financial and emotional ability to take investment risks.

- Limiting emotional decisions

Regular investing provides an opportunity to limit emotions when making an investment decision. Systematic investing cuts out the highs and lows and helps smooth out the long-term trend.

Sounds interesting?

The saying „Every little bit adds up“ is familiar to almost everyone. In today's consumer culture, however, it seems increasingly difficult to make this wisdom a reality. We even marvel at our parents, grandparents and great-grandparents who managed to set aside funds even with less income. Fortunately, you can now do it too! Once you've familiarized yourself with the basic features of the product as well as how the stock and financial markets work, requesting Systematic investment plan is the next conscious step towards greater financial freedom. And it will bring you the peace of mind to enjoy the things that are important to you.