APR explained

This abbreviation means Annual Percentage Rate. It includes the total costs on the loan for the borrower (interest, fees and commissions), expressed as an annual percentage. The APR is being stated to help you compare the available proposals for concluding loan agreements.

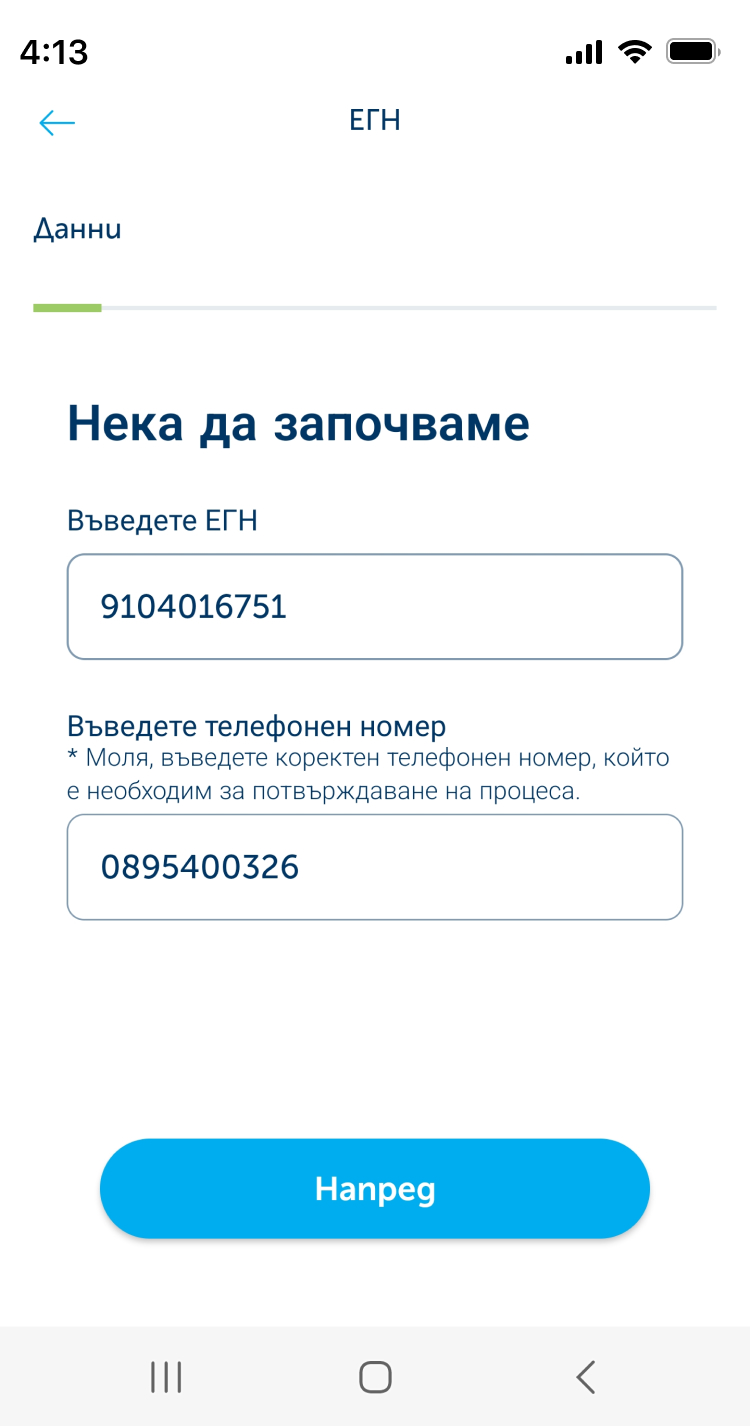

What are the requirements in order to apply for a consumer loan?

The standard requirements to you upon application are:

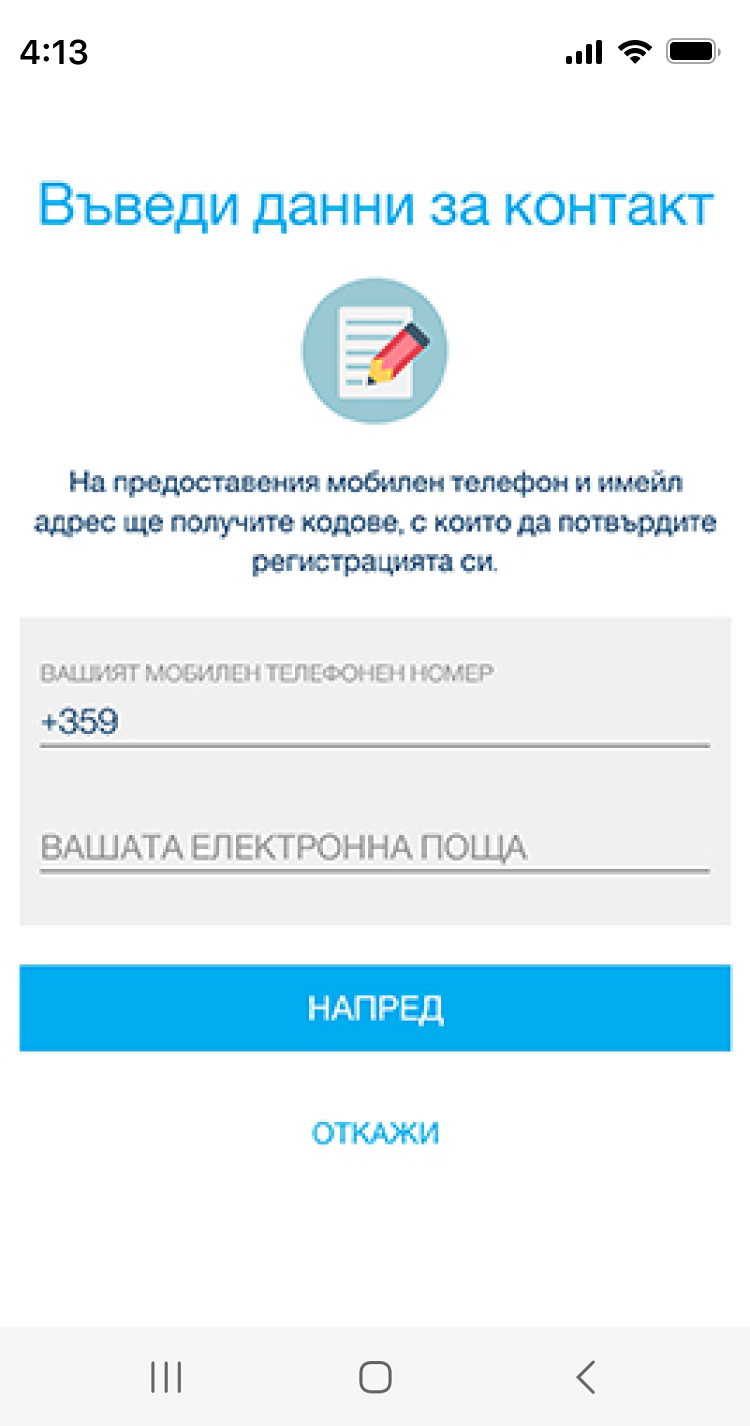

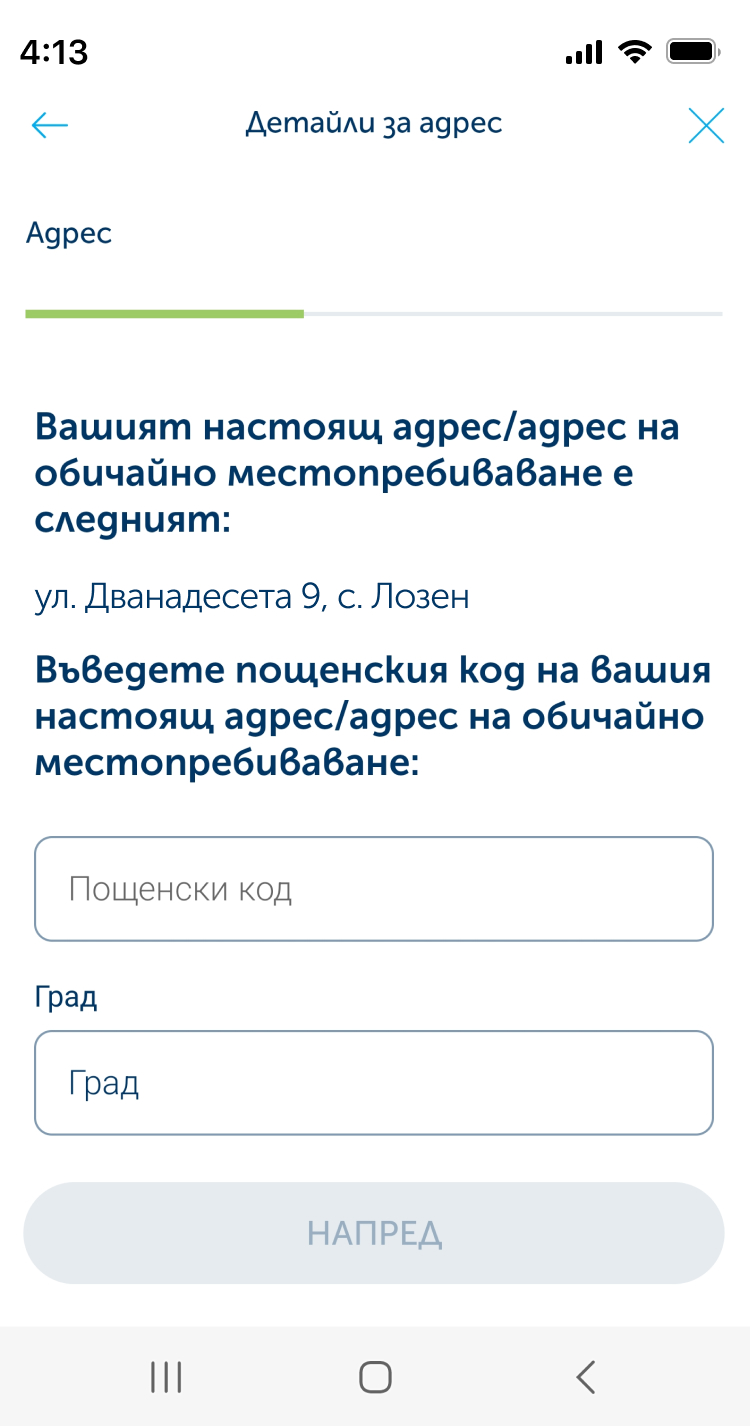

- You should be a Bulgarian citizen with habitual residence /present address/ in the Republic of Bulgaria;

- You should have income in Bulgaria, certified from official data sources or proven with the respective documents

- You should not have past due payables

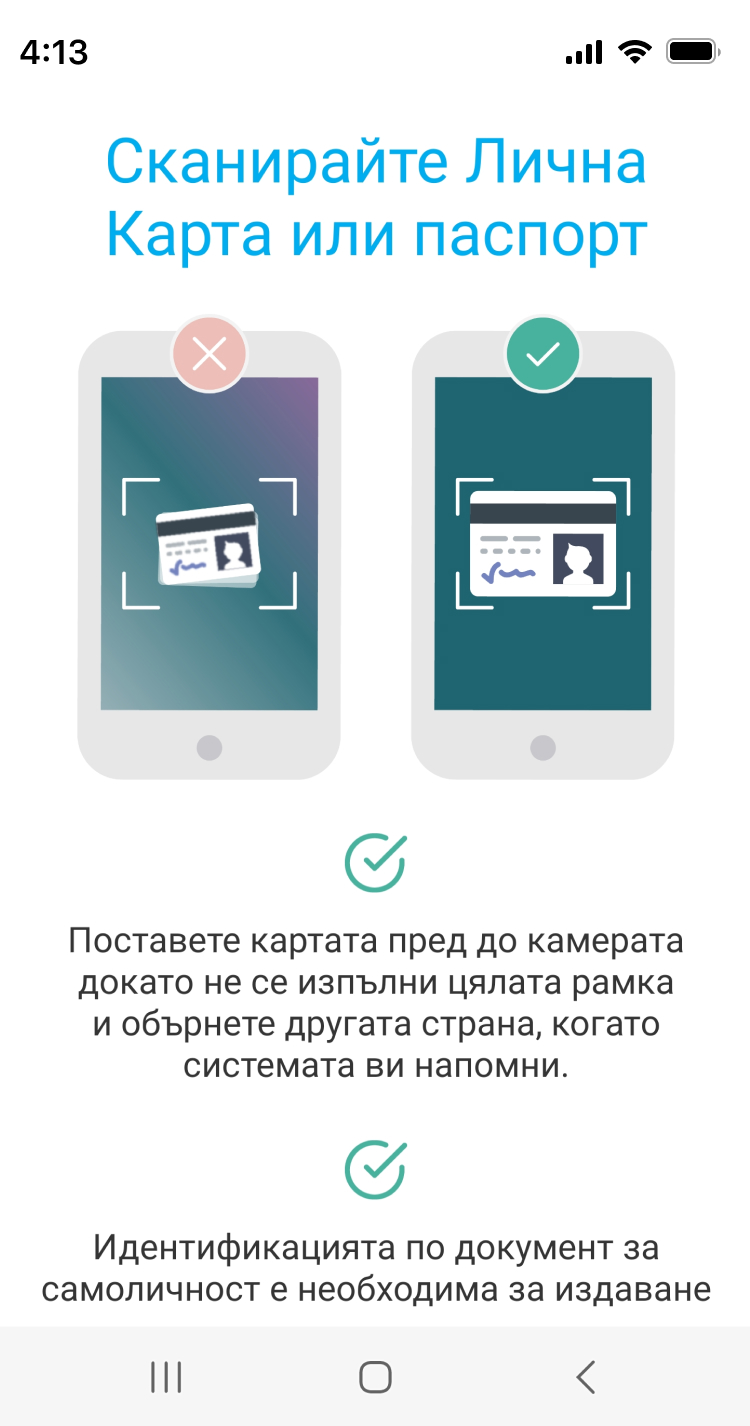

- You should have a valid identity document.

Do I need to have my salary transferred to UBB?

The salary transfer is not mandatory, however if your payroll is in UBB you will be able to take advantage of more favourable pricing upon loans with a variable interest rate.