The investment policy of the Responsible Investing funds is changing

26 January 2024

This message is intended for investors in one or more Responsible Investing funds, managed by KBC Asset Management NV, Belgium and offered by the distributor UBB AD.

With effect from 29 February 2024, the Responsible Investing methodology will change.

What is the reason for this change?

Through responsible investing, KBC Asset Management aims to support the evolution towards a more sustainable world. To keep up with market developments and newly imposed legal requirements on responsible investing, and to ensure that the methodology used remains sound, it is reviewed annually. This may lead to certain things being changed.

Which funds are affected?

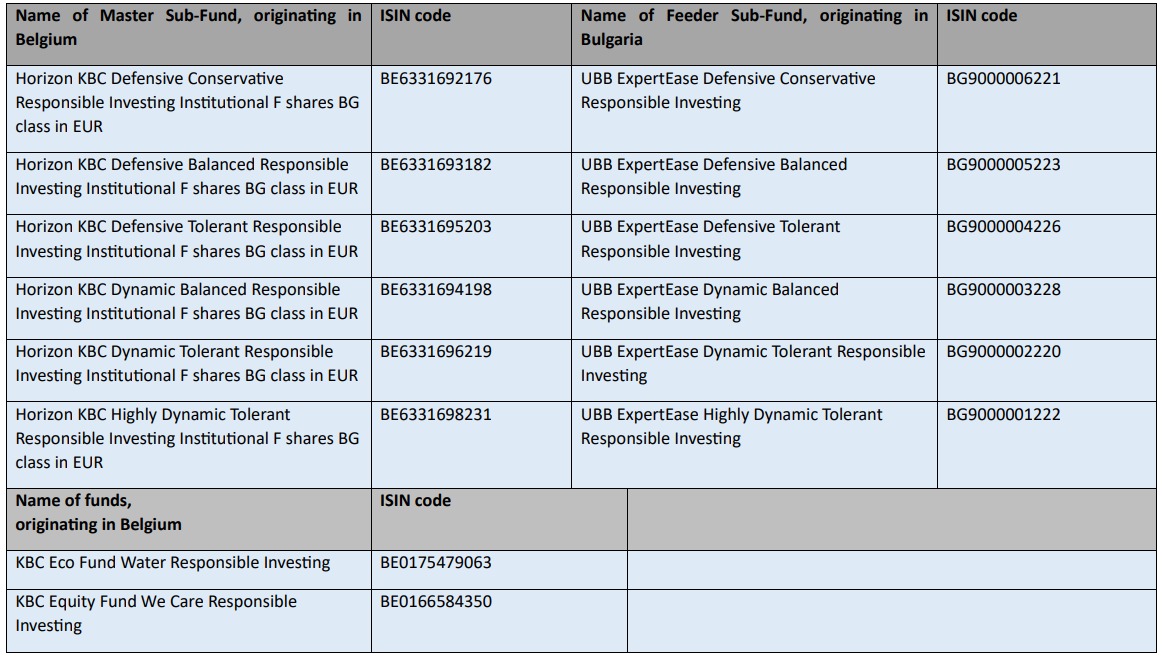

The proposed changes apply to all funds following the Responsible Investing methodology. These funds can be recognised from the term 'Responsible Investing' in the fund name. A full list of the affected funds are as follows:

What will change?

Depending on the fund in question, one or more of the following objectives may be adjusted:

· The minimum percentage of assets promoting environmental and/or social objectives;

· The minimum percentage of sustainable investments;

· The minimum percentage of sustainable investments with an environmental objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy;

· The minimum percentage of sustainable investments with a social objective;

· The ESG risk score for instruments issued by companies;

· The greenhouse gas intensity target for instruments issued by companies;

· Other specific objectives.

It is possible that some of the modified targets could be interpreted as being less ambitious.

What you need to do?

· If you agree to the proposed changes, you do not need to take any further action.

· If you do not agree with these changes, please contact the branch of UBB to add a different investment fund to your systematic investment plan or to discontinue your investments.

Require more information or have a question?

The updated Prospectuses and Kee information documents of the Responsible Investing funds, as well as other information, will be available on the official website: www.ubbam.bg, on the page of the respective fund, in the "Documents" section, as well as on the official page of the Distributor - UBB AD – www.ubb.bg, in the "Savings and Investments" section, as of February 29, 2024. The changes for the feeder funds will become effective if, by that date, the requested approval is issued by the Deputy Chairperson of the Financial Supervision Commission, Head of the Investment Supervision Department. Regarding funds originating in Belgium, approval was issued by the Belgian regulator FSMA on 20.12.2023, and the changes will come into force on 29.02.2024.

Upon request, you will also be able to obtain a free hard copy from any branch of the distributor UBB. Feel free to contact the distributor UBB for more information and clarifications if needed.

Upon request, you will also be able to obtain a free hard copy of the documents from any branch of the UBB distributor. If you need further clarification, do not hesitate to contact us. To contact the UBB bank's team, you can use the feedback form at www.ubb.bg or through the Customer Contact Center on phones: 0700 117 17 or +3592 483 1717 (contact number from the country and abroad) or *7171 (short) number for subscribers of mobile operators from Bulgaria), or visit a UBB branch.

Yours truly,

Team of UBB